2024

Celebrating the 75th anniversary

of our founding

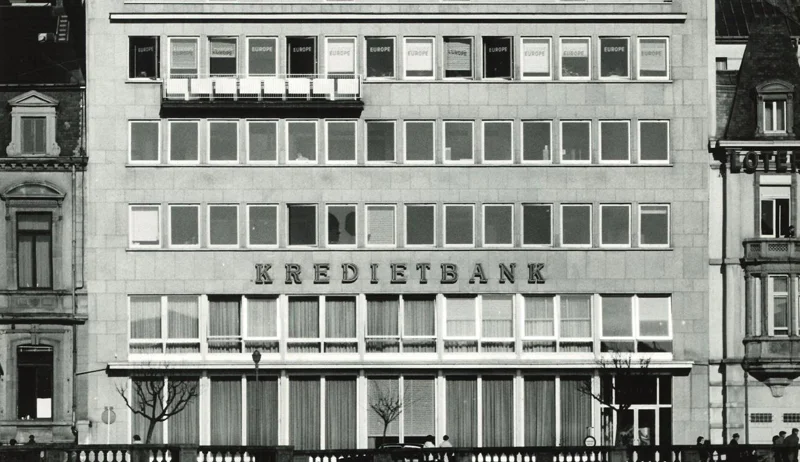

A once-small Luxembourg-based firm founded in 1949, Quintet Private Bank is today a leading private banking group. Headquartered in Luxembourg, Quintet operates in 30+ cities across Europe and the UK and employs some 1,650 professionals.

Quintet serves high net worth individuals and their families as well as a wide range of institutional and professional clients, including family businesses, foundations and external asset managers.

Quintet Private Bank opened its doors for business in Denmark in July 2020. As part of its ambitious growth strategy, Quintet Danmark is now focused on meeting the long-term wealth management needs of Danish individuals and their families.

Our mission

Quintet Private Bank’s wealth management approach is centered around personalized and holistic planning. They focus on understanding the unique needs and ambitions of their clients and how these might evolve over time

- Tailored Wealth Planning: Quintet works with clients to create a wealth plan that goes beyond finances, addressing what really matters in every aspect of life. This includes passing on wealth, working with entrepreneurs, and ensuring peace of mind for a clearer future

- Investment Management: Sustainability is at the heart of their business, and they aim to align investments with the client’s needs and objectives while also contributing to a better future. They start with a full suitability review before offering recommendations and actionable investment ideas

- Discretionary Portfolio Management: Clients can opt to have their investments managed by Quintet’s advisors, benefiting from the research and views of their analysts and investment teams across their network of private banks and wealth managers2.

- Lending Services: Quintet offers support with liquidity or additional funds when clients face unexpected opportunities or changes in circumstances

- Charities and Philanthropy: They have a history of managing portfolios for charities, reflecting their commitment to social responsibility

Quintet’s approach is designed to be both tax-efficient and consistent with the client’s risk appetite, ensuring that their wealth planning and investment strategies are well-structured and thoughtfully executed.

2020s

A pandemic leads to global lockdown, Russia invades Ukraine

& artificial intelligence enters the mainstream

2020

KBL epb rebrands as Quintet Private Bank

2021

Quintet opens for business in Denmark

Quintet Danmark opens for business in Copenhagen, then expands to Aarhus, the country’s second-largest city, in 2021

2022

Chris Allen appointed Group CEO

2023

Quintet partners with BlackRock

2010s

Emerging markets accelerate growth & global economy recovers

2012

Precision Capital acquires KBL epb

2014

Acquisition of UBS Belgium

2015

Acquisition of Hampton Dean

2016

Acquisition of The Roberts Partnership

2017

Launch of InsingerGilissen

2000s

Global financial crisis begins, dotcom bubble bursts & euro enters circulation

2003

Etienne Verwilghen appointed CEO

2004

KBL acquires Puilaetco

2005

KBL joins KBC

2008

Launch of Global Investor Services

1990s

EDotcom bubble rises & Japanese assets price bubble bursts

1990

Private banking becomes new pillar

1992

KBL acquires Brown Shipley

1993

Damien Wigny appointed CEO

1999

KBL acquires Merck Finck

1980s

Berlin Wall falls, Japanese asset price bubble rises & global markets collapse on Black Monday

1981

First ECU loan granted

1986

KBL invests abroad

1988

Jean Adant appointed CEO

1970s

Arab oil embargo shocks global economy & US experiences sustained stagflation

1970

Founding of CEDEL

1974

First-place ranking in Eurobond issues

1960s

Cold War intensifies & Europe enters economic golden age

1961

First bond issue

1963

First international loan denominated in US dollars

1965

Financial holding company introduced

1966

Constant Franssens appointed CEO

1967

KBL engages in Eurobond trading

Quintet's family of private banks

Locally rooted and financially strong